Current Ratio Higher or Lower Better

A ratio under 100 indicates that the companys debts due in a year or less are greater than its assetscash or other short-term assets expected to be converted to cash within a year or less. In the Arvind Case the Quick Ratio would have given a clearer picture.

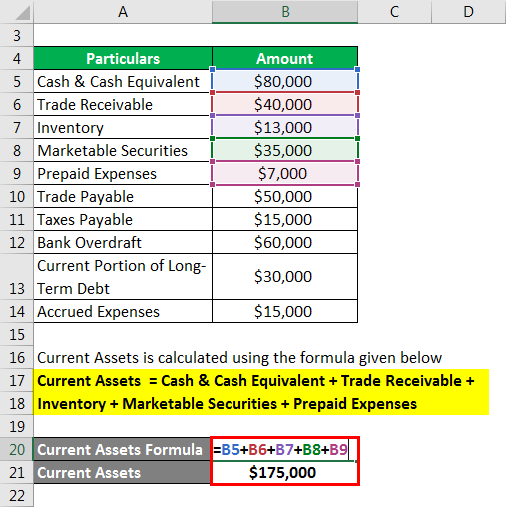

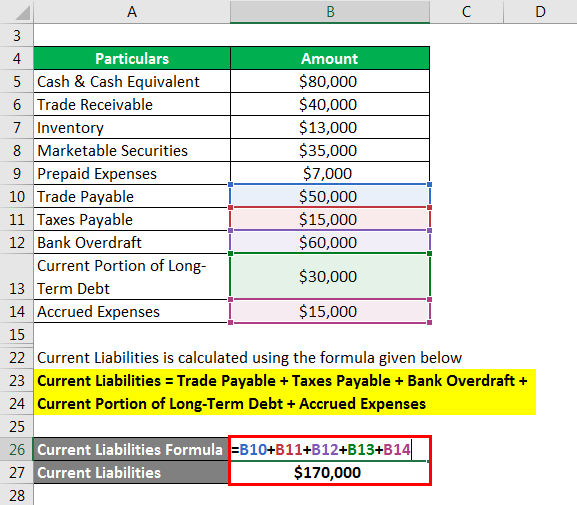

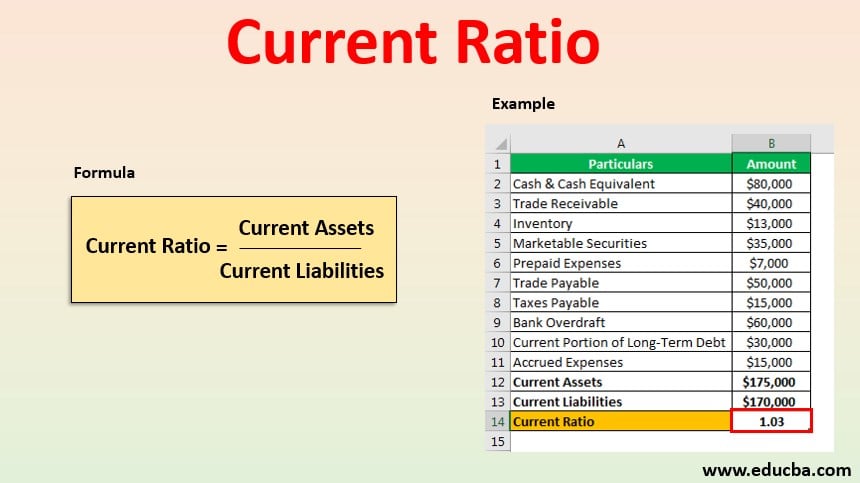

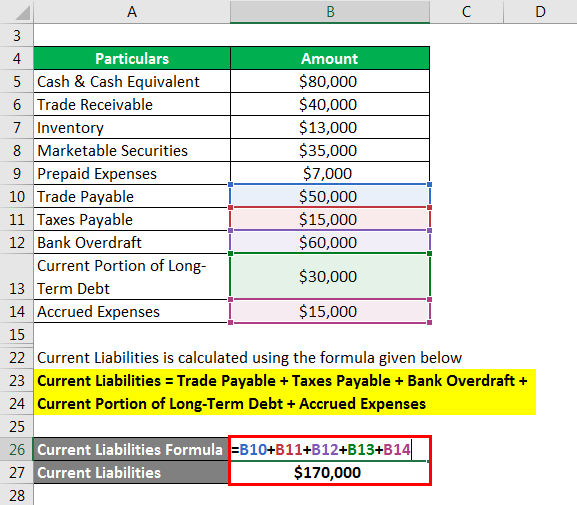

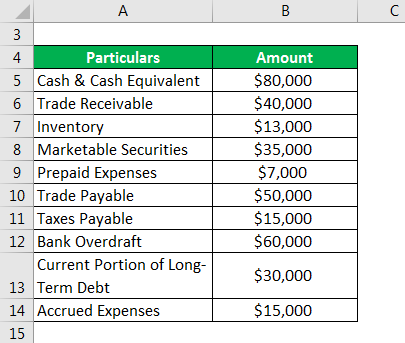

Current Ratio Examples Of Current Ratio With Excel Template

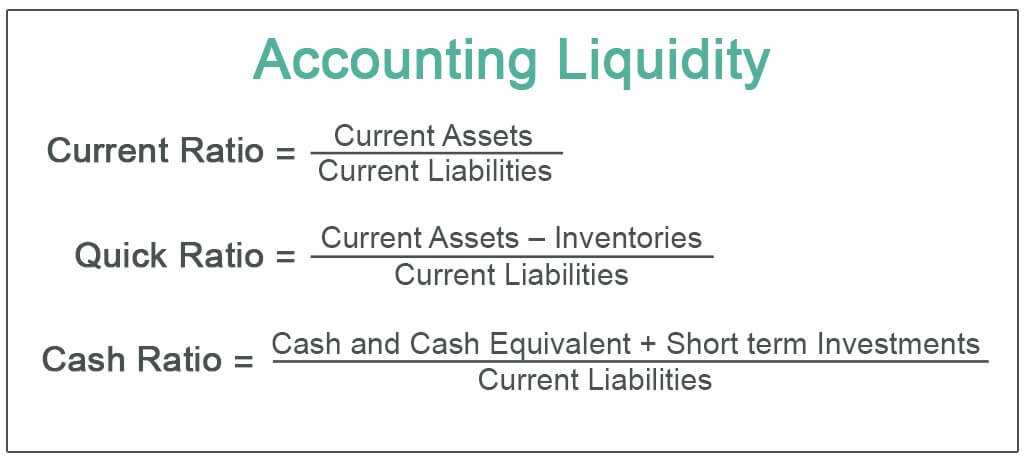

Quick Ratio Cash Cash Equivalents Liquid Securities Receivables Current Liabilities.

. A good liquidity ratio is anything greater than 1. It indicates that the company is in good financial health and is less likely to face financial hardships. Solved Which Case Is Better Higher Or Lower Why A Chegg Com.

Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets. Is a higher current ratio better. Acceptable current ratios vary from industry to industry.

All other things being equal creditors consider a high current ratio to be better than a low current ratio because a high current ratio. Yes A ratio can be too high or too low because companies should be trying to maintain the ratio within a specific band rather than keeping it too high or. In general a current ratio of 2 or higher is considered good.

If your current ratio is low it means you will have a difficult time paying your immediate debts and liabilities. 100 1 rating 1. The current ratio is an indication of a firms liquidity.

The current ratio is a number usually expressed between 0 and up that lets a business know whether they have enough cash to service their immediate debts and liabilities. A better way to interpret the comfort level of working capital is to. In general a current ratio between 15 to 2 is considered beneficial for the business meaning that the company has substantially more financial resources to cover its.

Current ratio Current Assets Current Liabilities. One option is to take advantage of. In many cases a creditor.

A current ratio of less than 100 may seem alarming although different situations can negatively affect the current ratio in a solid com See more. Acceptable current ratios vary from industry to industry. Current Ratio Formula Meaning Example.

Current Ratio Vs Quick Ratio Top 5 Differences To Learn With Infographics. The Asset Turnover ratio can often be used as an. The quick and current ratios are liquidity ratios that help investors and analysts gauge a companys ability to meet its short-term obligations.

March 31 2022 by guillaume boivin. The current ratio measures the organizations liquidity to find that the firm resources are enough to meet short-term liabilities and compares. Differences between Current Ratio vs.

A low current ratio can often be supported by a strong operating cash flow. From the example above a quick recalculation shows your firm now holds. The higher ratio the higher.

The quick ratio is an indicator of a companys short-term liquidity and measures a companys ability to meet its short-term obligations with its most liquid assets. A better way to interpret the comfort level of working capital is to look at the Quick Ratio. In many cases a creditor.

For example in a market that is flat or down low PE stocks should outperform while high PE stocks will do better in a booming market. The current ratio is an indication of a firms liquidity. The moral of the story is that a.

In other words purchasing those shares and related earnings is more expensive than investments with lower price-to-earnings ratios. Generally a higher price-to-earnings ratio. The higher the ratio the more liquid the company is.

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

Current Ratio Examples Of Current Ratio With Excel Template

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

Current Ratio Examples Of Current Ratio With Excel Template

Current Ratio Examples Of Current Ratio With Excel Template

Accounting Liquidity Definition Formula Top 3 Accounting Liquidity Ratio

0 Response to "Current Ratio Higher or Lower Better"

Post a Comment